How to make your NFT project a success? (14 min read)

NFTs are probably the biggest hype of 2021. Such a situation encourages newcomers to jump into the space, invest in creating their own NFT projects, and hope for repeating the success of the biggest brands. The problem is that 90% of them are doomed to be forgotten. How to make your idea successful?

If I knew the ultimate recipe for NFT success, I’d be living off those ETHs worth millions on some tropical island. However, I have some idea – I’ve been researching dozens of case studies of how various brands achieved their viral growth, including some projects around non-fungible tokens.

Mark Twain once said, „The history never repeats, but it does often rhyme”. Let’s spot the similarities between the most successful NFT projects and find out which strategies have proven at least several times to be successful. I always add the psychological aspects of why certain brands go viral, so I’ll also check why people jump into that space and why some projects are more successful than others.

Let’s jump into discovering the strategies, tools, and psychological aspects of making your project successful. But first – some basics on what NFTs are and what they are not.

A short story of Non-Fungible Tokens

The NFTs originated in the crypto space and are an important part of it. They weren’t that popular when they were first introduced in 2012 on Bitcoin, or when Counterparty arrived in 2014. However, they started to pick up in 2016 as Force of Will, the 4th largest trading card game, got published on Counterparty and later the same year, when Rare Pepes created the genre of meme NFTs.

2017 brought Cryptopunks and Crypto Kitties and this is where the real craze began. They all had been released on Ethereum blockchain and however it’s the 2nd most popular blockchain platform, it’s one of the older ones out there. As such, it’s not the fastest and most scalable, and issuing NFTs which contributed to a growing number of transactions happening on the chain led to numerous network congestions. You can imagine how that network gets congested in 2021 when there are thousands of other projects on Ethereum.

But let’s not forget that although Ethereum became the go-to platform for NFTs, it’s not the only blockchain that supports this technology. In fact, many other chains have seen major growth thanks to their NFT features. Binance Smart Chain, powered by Binance, one of the largest crypto exchanges, was one of them. Solana – which I covered recently – has more than tripled in price, thanks to its NFT capabilities. Algorand – another blockchain solving Ethereum’s problems has accumulated almost three times larger market capitalization, going from $3b to over $10b.

What are NFTs and what are they not?

Most known crypto tokens are fungible which means they aren’t unique. Bitcoin is Bitcoin, but it doesn’t have any characteristic that makes the one that you own special by any means. That also means you can own and transfer a fraction of BTC.

Non-fungible tokens are exactly the opposite – each one is unique. Similarly to collectible cards, you could say that each has its own value representation – be it artwork, music, video, or any type of media, and a unique serial number. It can also be limited in supply.

These tokens are issued on blockchains as smart contracts – once they’re live, the information about their existence, characteristics, and ownership is distributed to all so-called blockchain nodes, making it immutable. The record cannot be altered and every time the NFT switches hands, the information about it is also recorded in a distributed manner.

From the technical perspective, NFTs are more like a certificate of ownership. It proves that wallet address X has an NFT called ‘ABC’ and it’s the original one as its history can be traced back to its creator’s wallet address.

The NFT per se is in most cases, not the artwork, GIF or video. It usually points to some cloud storage where the original file is held. If it disappears there, then you have proof of ownership of something that does not exist anymore. That’s why more and more NFTs are moving to use IPFS (InterPlanetary File System, a cool name, huh?) which holds the files in a distributed manner, too. That only means much if you look at NFTs as digital art collectibles, though. More or less.

Why some NFTs are worth thousands or millions?

NFTs can be perceived as alternative investments and as such, their valuation is both easy and not. With NFTs, the problem of spotting real vs fake is marginal – you can always track the data back to the creator and see who was it and who owned it previously.

The valuation mechanism for digital art became similar to the traditional routes. If the artist builds his career, his works, especially early and limited in quantity will become more valuable. If he dies and won’t ever make any more–this loss is also turned into art’s value. It’s similar with sports cards – rookie cards skyrocket in value as the player works for his name, etc.

It’s always the dance of perceived value and real value which for NFTs might be criticized by some boomers, but in fact it’s the same. Caravaggio spent a few denaries on paint, but The Adoration of the Shepherds has been auctioned for over 800,000 USD 400 years later.

There are numerous factors that influence the value of an asset, but the expectation is that some NFTs can give extraordinary returns in the future, just as other alternative investments do.

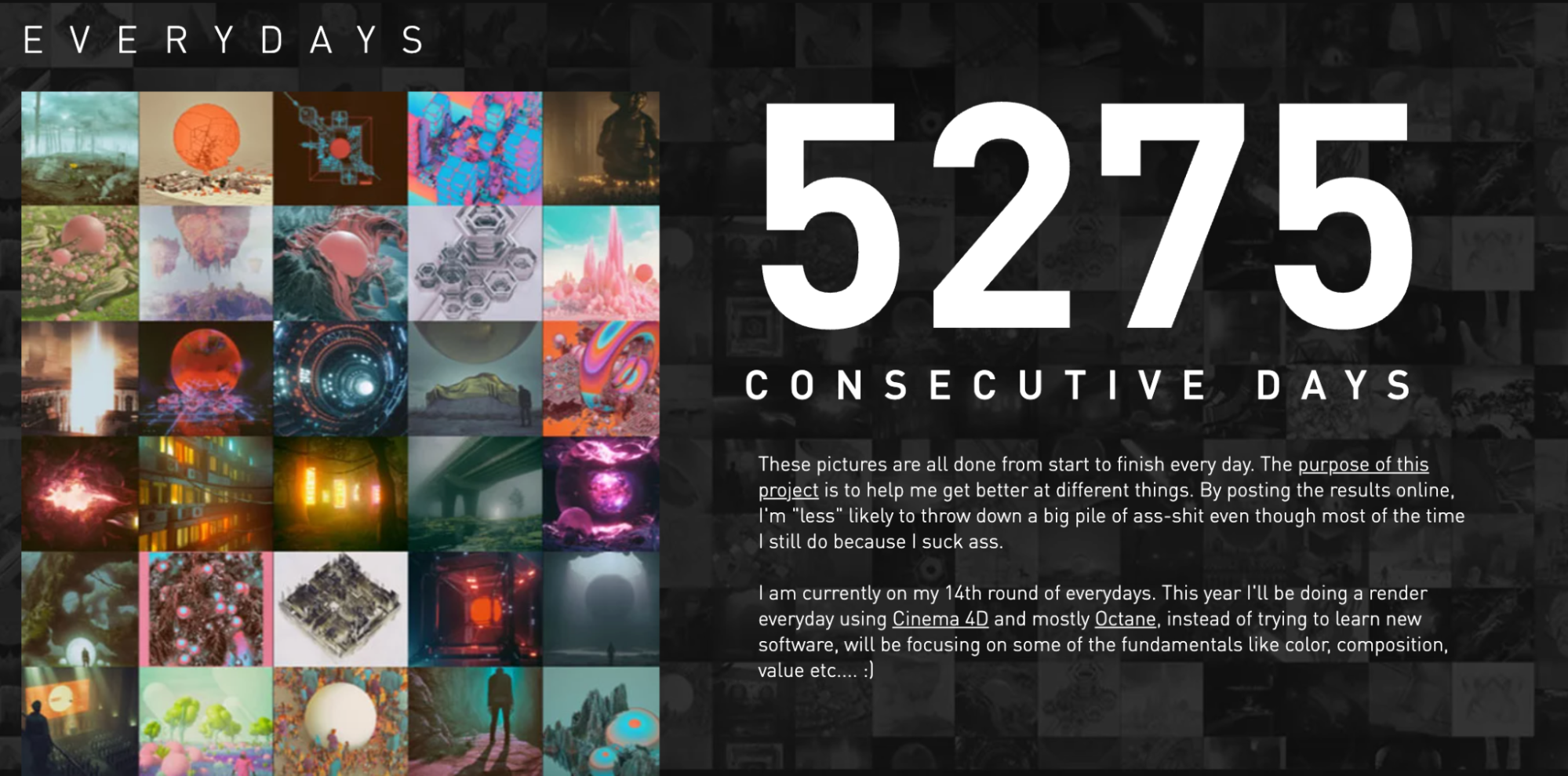

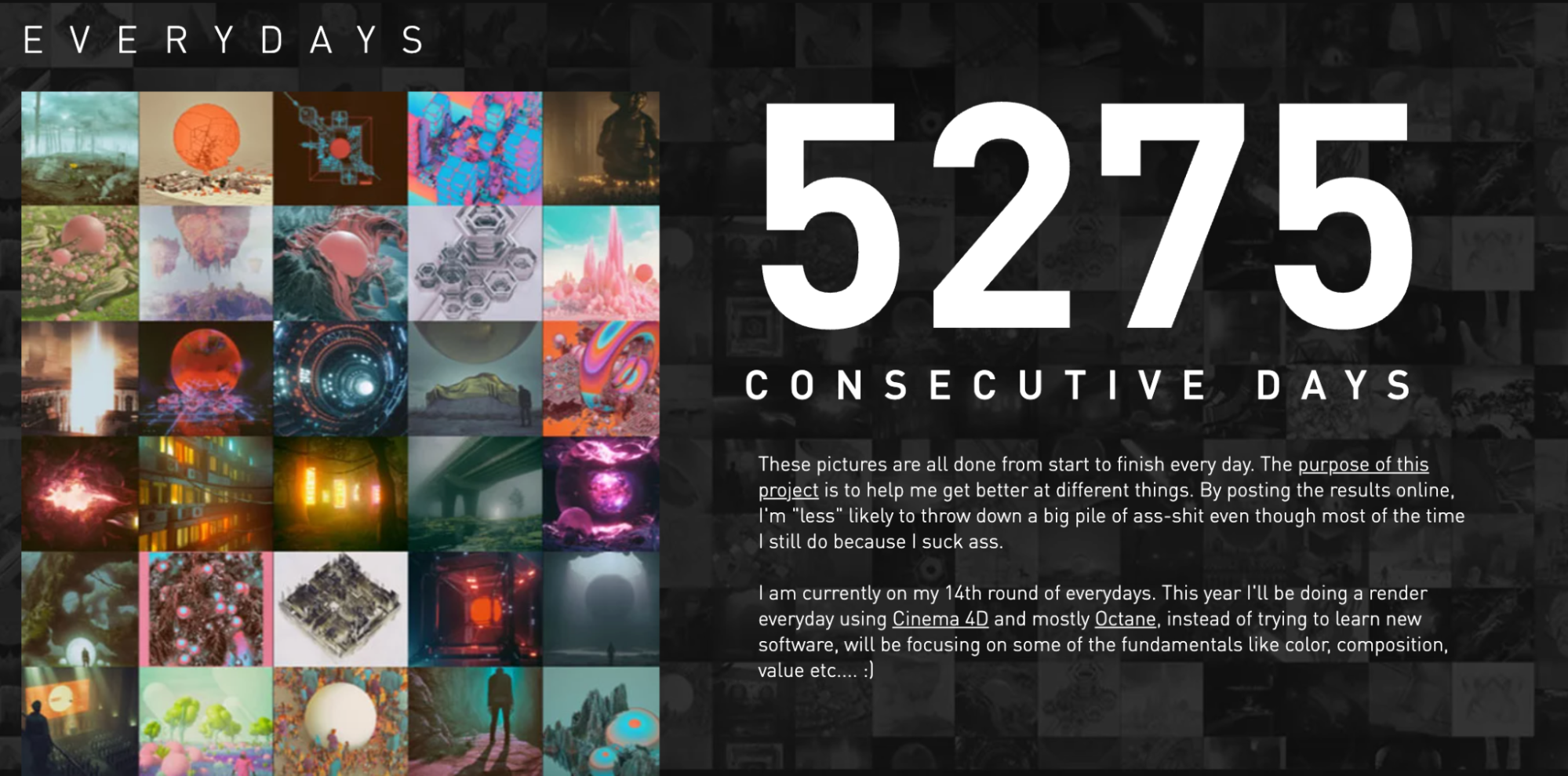

Everydays, NFT collection by Beeple, was sold for $69M at a Christie’s auction. It was advertised by Christie’s as „a unique work in the history of digital art” and was a commentary to over 5,000 days since 2007. It was one of the first to move the needle for the NFT space, but let’s not forget – the hype was already there and it only helped boost the price.

Another factor for valuation. So it’s not that easy after all!

What are the most remarkable NFT projects?

There are dozens of thousands NFT projects out there and – unsurprisingly – most of them aren’t successful. However, let’s follow the survivor’s bias and check which NFT projects got the most fame in 2021.

Apart from the Beeple’s, the first most notable projects were Crypto Punks and Crypto Kitties. Crypto Punks were a set of 10,000 pixelated characters with attributes of different rarities. They turned out to be a success and because of that, many other projects followed the pattern.

Among those, there were Bored Ape Ycht Club, Mutant Ape Yacht Club, Polymorphs, Weird Whales (created by a 12-year-old), and a few more. You can also create similar generative content through Art Blocks Curated.

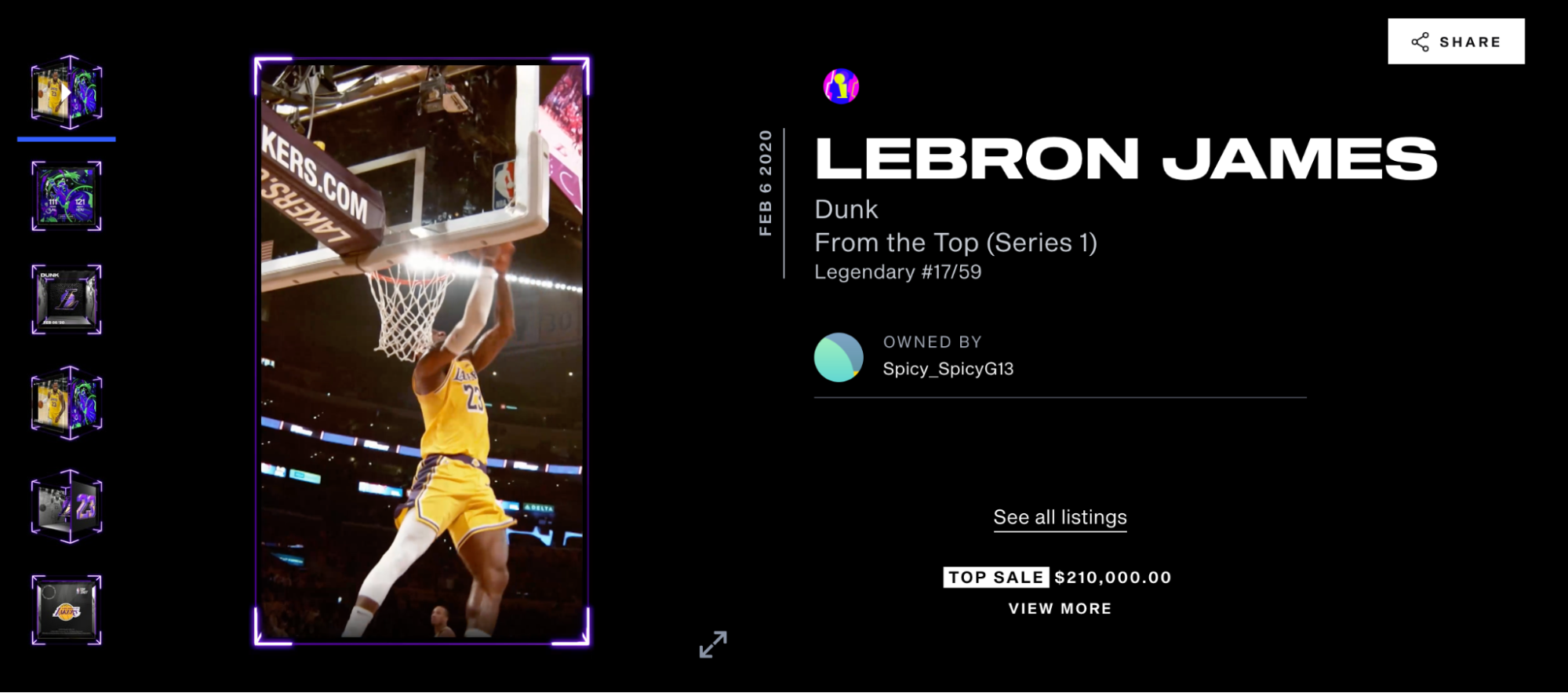

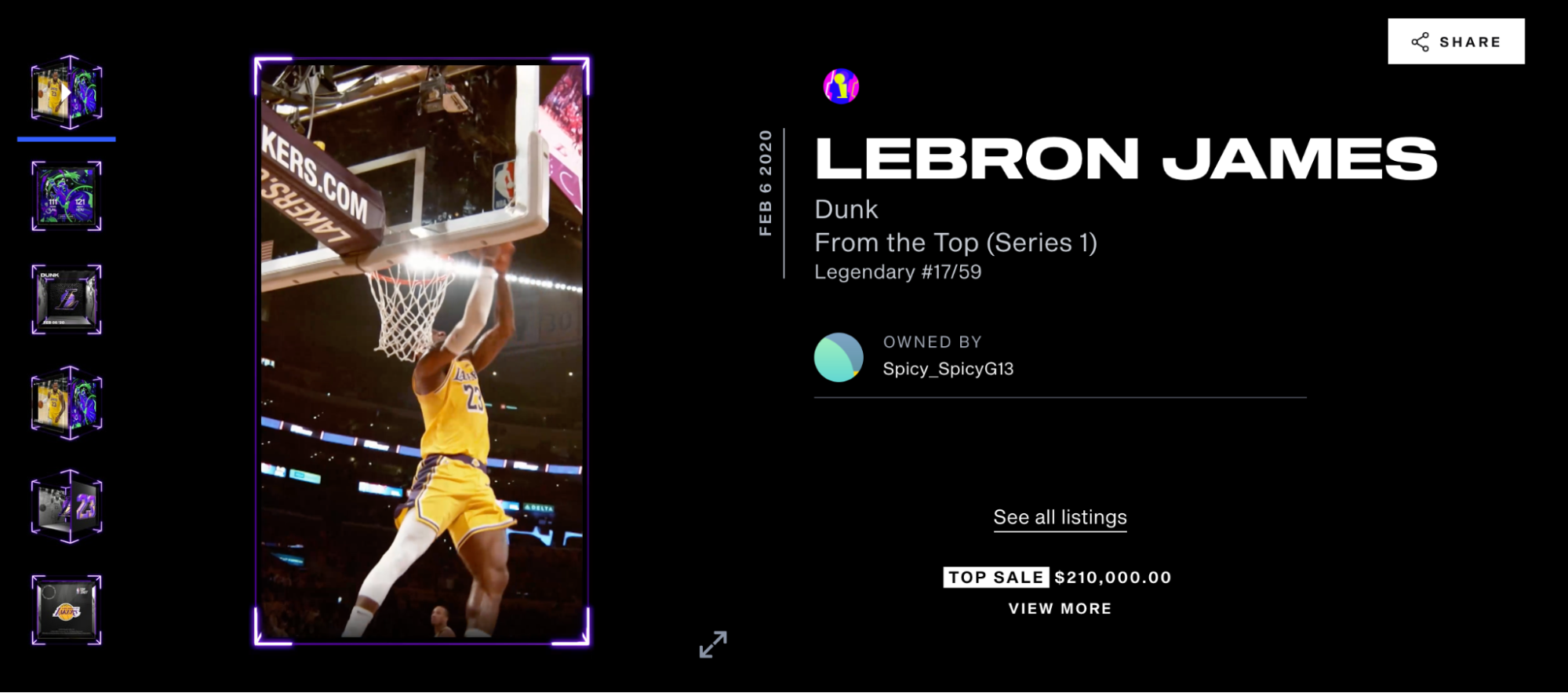

There are also Decentraland and Sandbox, which are essentially blockchain-based virtual worlds, although one of the most hyped projects is NBA Top Shots. It brought mainstream attention to the crypto and NFT space and attracted new users through record-breaking sales in a new version of basketball cards. It’s similar to Sorare which is Top Shot’s football counterpart.

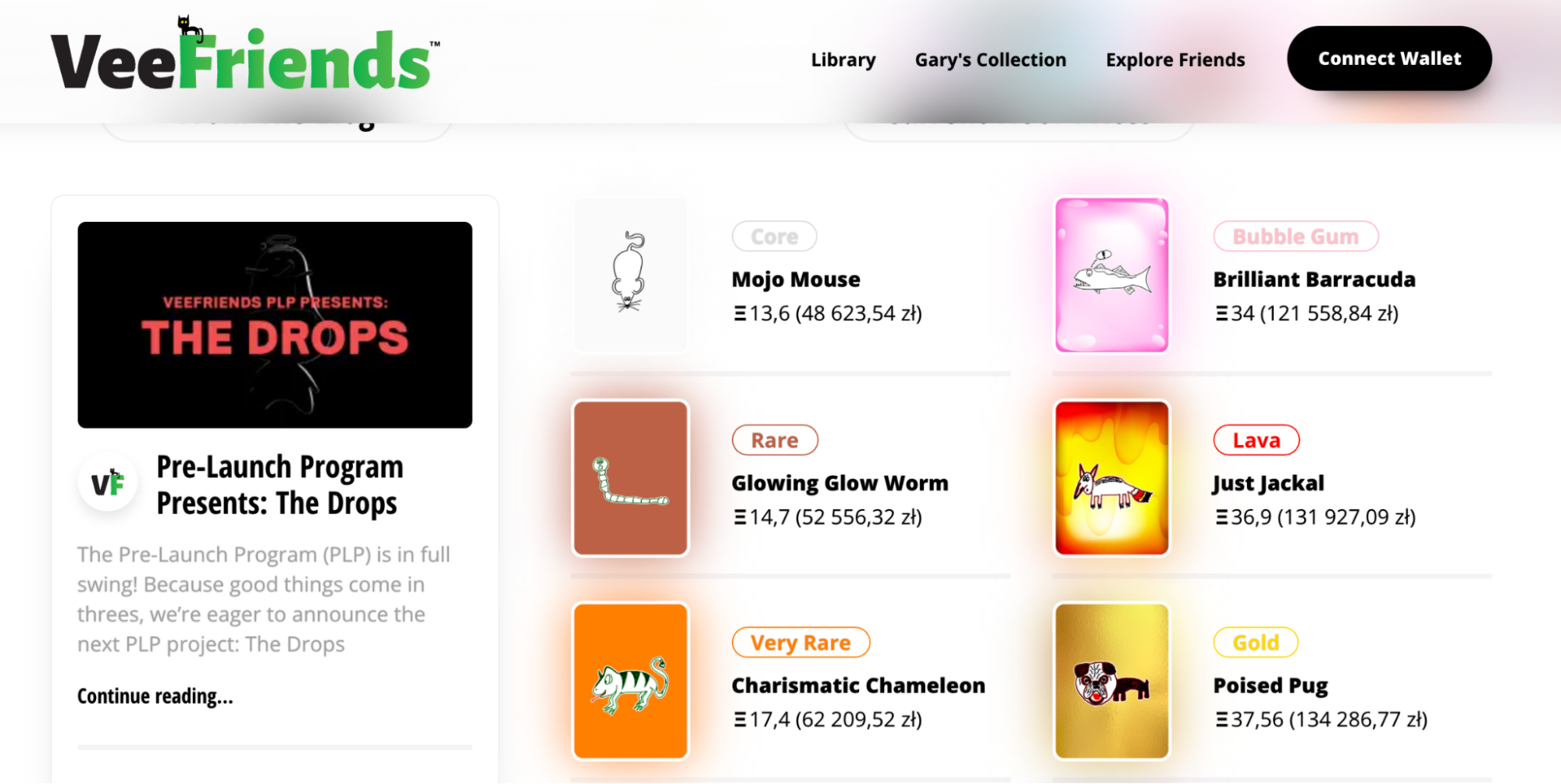

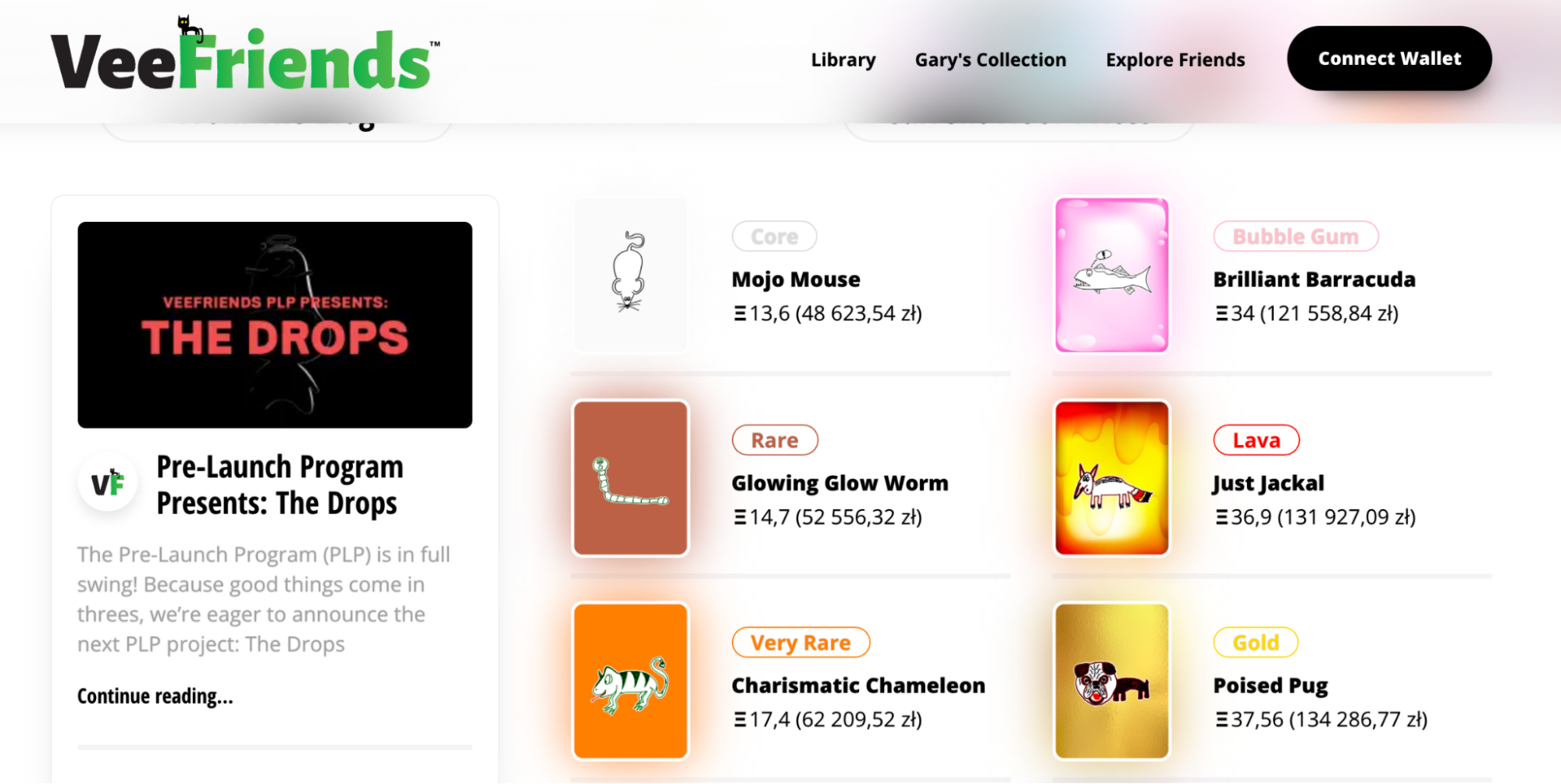

Another remarkable direction is Gary Vaynerchuk’s VeeFriends. He created his own NFT collection of hand-drawn characters that resemble his personal values – which are part of his personal brand. However, it’s not only about the art but all NFTs come with certain perks, like an entrance to one of Gary’s speaking events, the opportunity to have a call or dinner with him etc.

Axies Infinity is an NFT-based game similar to Crypto Kitties, but what’s special with it is how it onboards new crypto users while also providing income to people in developing countries. In fact, whole villages in Phillippines play Axies and make a living out of it.

What’s wrong with NFTs?

The NFT market is far from being saturated one year after becoming more mainstream, but it’s in a state in which many newcomers are in a vulnerable spot.

Many people have joined the trend, looking for a quick buck. They bought some tokens without much thinking, ending up without cash and with worthless „art”. You need to be careful in emerging spaces, especially as the lack of regulation means freedom, but it also leaves careless investors at risk. This relates to the whole crypto space, though, and NFTs are just the latest thing there.

Most NFTs are based on Ethereum blockchain. It’s 6 years old already, and it’s known for lagging behind newer blockchains in terms of speed and scalability. CryptoKitties were known for numerous network congestions, and now there are thousands of other projects that keep jamming Ethereum. That will change eventually with a planned update, but it keeps being postponed.

Another problem with Ethereum is the gas fees which are the transaction fees and during most busy times, they can go up to even $300. Even at the time of writing, they are at $100 and this means, that if you want to mint a new NFT or sell it to someone, it would cost you $100 to have it processed by miners. Now, do that with an NFT that costs $9.

The last point which I’ll mention here is centralization. It might seem an issue mostly for the people that are die-hard crypto fans, but in fact – the whole advantage of blockchain is decentralization. Decentralization gives you control over your NFTs – you hold the keys to your own wallet that can store the NFTs.

However, NBA Top Shot was such a success because of the so easy onboarding. You can buy the cards with crypto, but you can also do that with a credit card. Although the NFTs are held on a Flow blockchain, the fact is that users never get their keys to their wallets. That means – if they lose their password, they can regain the account access or that they don’t have to set up any wallets and be that tech-savvy to do that, but at the same time – if NBA Top Shots decides to close the platform, they have it all – money and tokens. That’s the level of trust in a party that blockchain solves exactly through decentralization – no one can shut down something that’s propagated in numerous copies organically.

Although these issues might have a play, the market is so hot on the NFTs, that they don’t really matter at this stage. More and more projects hop on the trend and launch their non-fungible tokens successfully. But how do they do that?

What strategies are common to make NFTs successful?

- Snowball effect

Looking at the highlights, you can see how the snowball got bigger and bigger. The most notable NFTs have been released in similar timeframes, while the longer they were on the market, the more new NFTs were created.

- Supply and demand

NFT markets work similarly to sports cards. There’s supply & demand - the rarer the collectible is, the higher its price might be.

- Provable origin

NFTs have an immutable history of ownership. That means it’s extremely easy to tell if the piece you’re looking at is the original or a copy. As with many blockchain-based projects, that remopves the middlemen - you don't need anyone to verify the authenticity of what you’re buying. That’s especially interesting for digital art collectors.

- A rising tide lifts all the boats

Both waves of the NFT frenzy have been the consequence of Bitcoin (and other cryptos) reaching all-time-high prices. That’s on Nov 2017-Feb 2018 and Nov 2020-early 2021 (it’s still not over).

Another timing factor is the pandemic. It’s said that during lockdowns around the whole world, 50% of the global population spent most of the time online. That led to savings (as many people didn’t have to commute) and the rise of the interest in stocks and other forms of investment. Crypto is appealing to Millenials and since Bitcoin got so expensive that it looked like a past opportunity for latecomers, they started to look for other blockchain investments - such as NFT.

- Well-known brands and influencers

Although the most expensive NFTs were mostly brands of their own, the big players have come to the party as well. There’s NBA, Formula 1, Gary Vaynerchuk, NBA players, Michael Rubin, Mark Cuban, Lindsay Lohan, and many more.

- Get-rich-quick scheme (for some NFTs)

Seeing big sales on the network builds the hype around certain NFTs as well. Some collectibles raised to thousands of dollars in value almost overnight. This is why more and more new collectors join and want to try their luck, sometimes making not necessarily wise choices. That’s especially effective as for rather small investments, you might expect big returns.

- Buzz Marketing

New NFT projects rise almost every day now, and they still get their share of the market. That’s because there’s so much buzz around digital collectibles and so much money to be spent or invested.

- Active Communities

The most popular NFTs have large communities around them. That makes the experience more fun and engaging.

Why did it work from a psychological standpoint?

- The Bandwagon Effect

The NFTs are getting early adopted by crypto investors and then bring more mainstream users to the community. The more popular the space gets… the more popular it gets.

- Scarcity

The perceived value of rare items is higher than their real value. Even though for many the idea of collecting digital tokens might be hard to understand, they come for the sense of owning a rare item. The long queues for NBA Top Shot pack drops are another validator.

- Social proof

So many people active in the NFT space and celebrities with large followings joining the hype, they create social proof to others–that NFTs are the thing worth investing your time. Such validation is enough to invest into NFT for the first time.

- FOMO

Bitcoin reaching all-time highs made crypto appear to the mainstream public. This builds the Fear of Missing Out in investing, which makes people invest while it might be too late to make a decent return. Those who see it as it’s too late looked for ‘the next big thing’ and NFTs have a lot to believe that.

- Overconfidence effect

90% of drivers think their skills are above the average, but they are not. Overconfidence in investment makes investing seem less risky than it actually is.

- Dunnig-Kruger effect

Beginners seem to be especially overconfident with assessing their skills. While having less skill, it’s harder for them to recognize their own incompetence. That might be the case for many ‘meme investors’ who became interested in stocks and crypto during 2020 lockdowns.

What can you do about it?

NFTs got so popular because of the right market conditions and timing, as well as a decent, visionary product. That proved to be right two times in a row, with the first and second Bitcoin price rally. The timing is often overlooked, but it’s one of the key ingredients of building successful projects and businesses.

Get your

"oh sh*t, this might work for us!"

moment in the next 5 minutes

Discover unconventional, easy-to-use, and low budget,

or cost-free methods of acquiring customers and increasing sales!

Viral marketing case studies and marketing psychology principles that made hundreds of millions in months or weeks

In the first email:

- a step-by-step strategy that made $0-$30M within 9 weeks with $0 marketing budget (case study)

- cheatsheet (PDF) of 10 biases in marketing used by top 2% companies

Other than that:

- weekly original content that helps you STAND OUT by providing more perceived value with less work

(You won't find it anywhere else)

Explore Cognitive Biases in Marketing